Top Reasons People Choose Bankruptcy

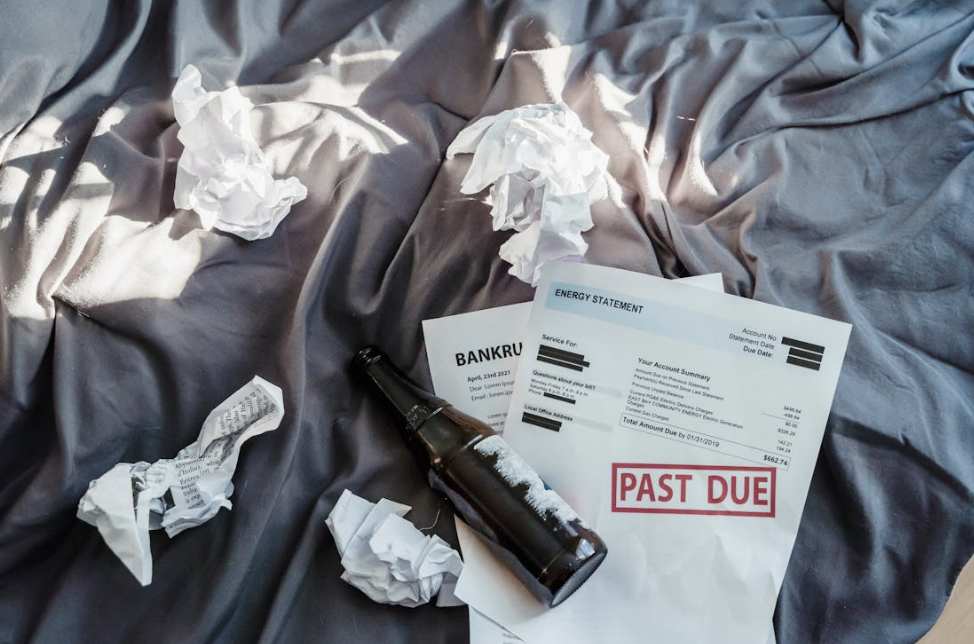

Bankruptcy has always been something that's kept taboo and hush-hush. Some people choose not to talk about bankruptcy because they believe it makes them a failure regarding their finances, but that's not the case. There are so many common reasons people file for bankruptcy because so many are filing for it. We are not living in a fair world where salaries match inflation and our outgoings meet our incomes.

Almost all of us live above our means because the means have become so out of reach. It's important to realize that choosing bankruptcy doesn't make you a failure, and a debt defense attorney will tell you the same thing. Understanding why you are in this position takes a lot of self-education and research, but you can come out of this space on the other side in one piece. Let's look at some of the top reasons people choose to go bankrupt.

They've lost their income. One of the most significant strains on finances is losing your income in the first place. If you've lost your job, whether that's due to illness or no fault of your own, such as redundancy, and you haven't managed to find something new to replace it so that you can continue to meet all of your expenses. Then, you will need to look at bankruptcy as an option. Losing your job can also mean losing your health insurance, making you very vulnerable to more significant medical expenses unless you find insurance. It can be devastating to lose your job, but losing your income can have a knock-on effect on everything else in your life.

Medical expenses. If you are living in the US, then you understand that the capitalist hellscape that is the health insurance business is going to be on your back. Medical expenses are another major factor contributing to bankruptcy in the US, and medical problems can also lead to job loss. If you've lost your job and your insurance, then you suffer medical issues; you're still going to be faced with a bill unless you go bankrupt.

Your mortgage has become unaffordable. Home mortgages are typically the most significant household debt in the US and most of the world. They far surpass credit cards, student debt, and car loans. And if you can't afford your mortgage anymore and your house goes into foreclosure, going bankrupt could be your only option. Lenders will sometimes approve a buyer for a larger loan than they can afford to pay, and if that's the case, you risk losing your home to foreclosure if you don't make the repayments.

Bankruptcy is not a life-ending thing. Anybody can come back from it, and while it takes some time to take bankruptcy and any other credit misses off your credit file, you can still stay on top of your life. If you’re struggling with debt but not quite at the point of bankruptcy, it’s possible to turn things around. Professional advisors like Alex Kleyner often talk about how you can do this.

The Breakfast Leadership Network team has partnered with MyDebtNavigator, which specializes in helping people like you regain financial freedom.

Our no-obligation or upfront cost debt consultation connects you with an experienced advisor who will:

Review your current debt situation

Offer personalized solutions tailored to your situation

Help you create a plan to break free from debt—for good

A key thing for me is that the team at MyDebtNavigator is helpful and does not judge you on your current financial situation. You've beaten yourself up too much already on that, so they're caring and here to help—no strings attached.

It's just real help from someone who cares.

Explore insightful conversations on workplace culture, burnout, and leadership at the Breakfast Leadership Network, ranked Top 20 globally. Join us to thrive in the modern work environment.

Please stay connected with us! For more insights and valuable content, don't forget to check out the following resources:

Breakfast Leadership Show Podcast: Tune in to our podcast and be inspired by leadership lessons and success stories from top industry leaders.

Breakfast Leadership YouTube Channel: Subscribe to our YouTube channel for ceadership, personal development, and more. content

- **Hire Michael D. Levitt to Speak**: Looking for a dynamic speaker for your next event? Hire Michael D. Levitt, the founder of Breakfast Leadership, to share his expertise and insights.

Follow us on LinkedIn for the latest updates. Remember to share this article with your network!